Running an insurance business is not an easy task!

Even business leaders outside the agency world acknowledge this, and agency owners experience this firsthand. Many “normal principles” that apply to other businesses simply do not apply to the “Agency world.”

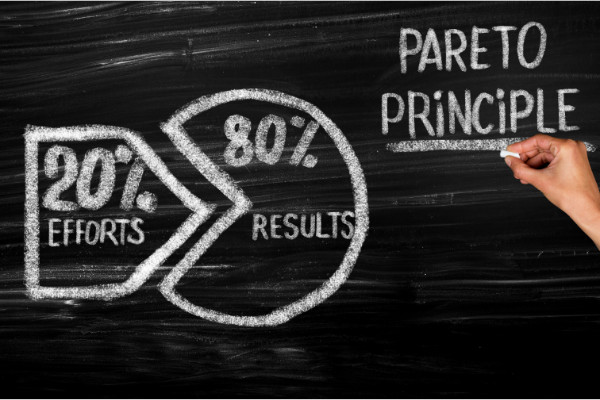

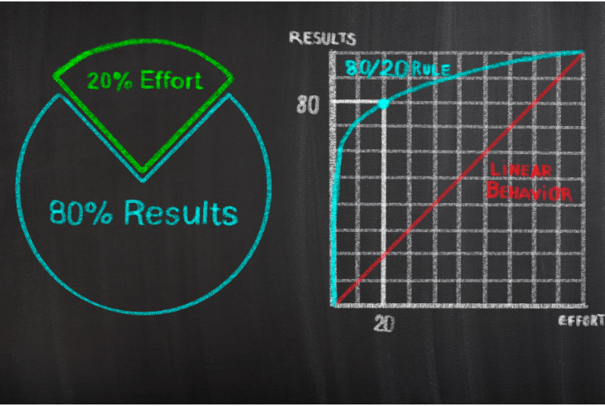

My favorite illustration is the 80-20 rule.

The 80-20 Rule Emphasizes on Focus

The 80-20 Rule Emphasizes on Focus

This rule also has other names like:

-

The Unfair Advantage

-

The law of the vital few

-

Principle of imbalance

-

Principle of factor sparsity

This rule is referred to by many coaches, mentors and thought leaders in business management to focus efforts, resources, monies and time on the vital few aspects to maximize outcomes.

A simple interpretation of this in a business context is “80% value comes from 20% effort”; the most relatable one is “80% of the business comes from 20% of the customers”.

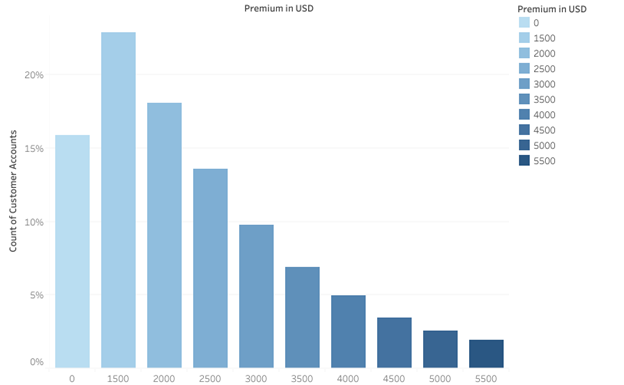

Let us apply this to the most voluminous segment of an independent agency in terms of customer count and policy count: the Personal Lines business.

Consider the following:

- Majority of personal lines customers are monoline

- Most monoline policy premium ranges from $1,400 to $1,800

- Rounded accounts (client has both auto and home insurance) the overall account ranges from $2,800 to $3,600 for the average household (which comprises the majority of the US population)

So, if we approximate the following values:

- Average value of $1,600 per account for Regular customers

- Average value of $3,200 per account for VIP customers

- VIP customers are 20% of the population

- Regular customers are 80% of the population

A quick calculation shows that VIP customers (limited to 20% of the overall personal lines customer count) contribute to approximately 67% premium, and the remaining 80% contribute to 33% premium. This, as you may have noted, is not as per the “80-20” rule.

The fundamental reason for this is that the variation in per account premium of personal lines business is very less. The basis of the 80-20 rule is that a significant few accounts can contribute very high value to the business. But the nature of the personal lines segment of Independent Agency business is such that this variation is less in supply.

The majority of Personal Lines Accounts Do Not Provide Much Variation

So, does the 80-20 rule not apply? Yes. But the Law of Significant few does apply. Our industry is different and has its own set of rules. Statistically, targeting 60-30 is practical and possible. Many well-to-do and growing agencies exhibit an operational tendency to align to the 60-30 metric.

A lot of well-to-do and growing agencies show this behavior. Some intentionally and some unintentionally. Alignment to this target helps them accelerate growth. Not surprisingly, they have strong cross-sell and upsell programs and engaging customers.

The concept of focus is important for success. Whether by “type of business” or “segment of customers,” focus will lead one to the 60-30 achievement. “Money-balling” agencies grow on a healthy mixed diet of existing customer engagement driven by focus and dessert of new business acquisition by smart marketing and sales.