Look no further than your agency's book of business. Like so many things, the answer seems simple, almost too simple. If you're looking to increase your revenue this quarter, focusing on your existing clients offers multiple benefits over new business production, including speed, ease, cost, and lifetime value.

So, where do you start?

Build a "Next-Level" Rounding and Up-selling Program

No matter how focused on rounding out accounts you are, the truth is that there is still an amazing amount of opportunities for additional policies sitting in your book right now.

Yes, this is an age-old concept. By now, everyone knows that selling additional policies to your clients is important for so many reasons. Immediate additional revenue, increased retention, and increased lifetime value are at the top of the list.

The million-dollar question is how?

EXPAND YOUR VIEW OF "ROUNDED ACCOUNTS"

"That account is rounded. We write the Auto and the Property."

It's time to expand how we define "rounded accounts." Do you also write their life insurance, secondary home, umbrella, and their long-term disability? What is your cross-penetration between Commercial Lines and Personal Lines? Surely all Commercial Lines clients also have Personal Lines needs?

As we discussed above, insureds have a variety of needs. The more you can solve for within your agency, the better it is for your business and the easier it is for your insured.

KNOW WHERE YOU ARE AND WHERE YOU WANT TO GO

The first step in building and implementing any successful business program is to determine your current and future desired state – you need to set goals.

A few Key Performance Indicators (KPI's) to consider:

-

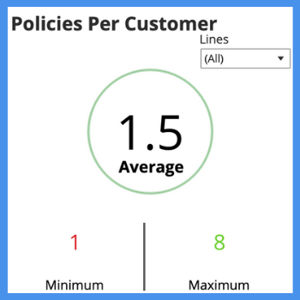

Average Policies Per Client – to determine your current rounding performance and determine your goal, you need to know how many policies are you selling to each client.

-

Average Policies Per Client by Department (PL/CL)

-

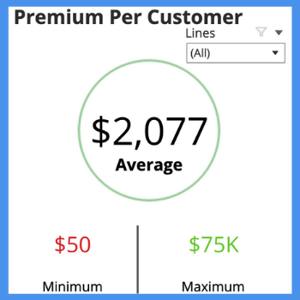

Average Premium Per Client – to determine your current upselling performance and set your goals, you need to know how much premium is generated per client

-

Average Revenue Per Client – how much revenue are you generating per client?

-

Cross-sell Commercial Lines to Personal Lines – how many commercial lines clients also have personal lines with you?

If you don't have these reports already set up in your agency management system, you'll need to spend some time working with your data to determine what reports are possible to generate.

Can't get what you need out of your Agency Management system? You're not alone. Outside of traditional "auto and home rounding," understanding your current performance and uncovering rounding and cross-selling opportunities has been challenging.

Agency Management reports can be difficult to run, and the data may be inaccurate. Agents have often had to rely on carrier reports to work from, which doesn't give you a holistic view of your book and is difficult to manage operationally.

Systems User Groups can be an excellent resource when trying to overcome reporting challenges, as can Agents Groups. Numerous Agent groups can be found on Facebook – once you have access, you can throw the question out to the group and solicit feedback from others who've worked through this. Larger projects, especially ones involving data clean-up consultants that specialize in agency management systems, can lead you to better data and better reporting.

Another option may be to leverage a new set of technologies and tools that can help you to understand your current performance better, recognize and capitalize on opportunities for revenue generation.

New platforms such as DONNA for Agents can comb through your agency management data providing you with key metrics such as policies per client, premium per client in a single, easy-to-digest dashboard.

This will save you some of the time and aggravation associated with manipulating your agency management system reports.

FULLY COMMIT

Lack of follow-through is a major roadblock for successfully and quickly launching a successful revenue generation program.

Before you go any further, make sure you're fully committed. Don't waste precious time or energy on something that you won't be able to see through and focus on. To avoid overextending yourself, decide on one or two strategies that you will have the bandwidth to focus on and invest in fully.

Regardless of what you decide to do, it's critical that you establish and clearly communicate goals to your staff and implement a system to track the programs' collective and individual results. The old saying really is true, "If it's not worth measuring or managing, it's not worth doing."

IMPLEMENT A "FULL COURT PRESS"

At this point, you've taken a close look at your current performance, and you've set appropriate goals. Now it's time to develop and implement a plan to accomplish those goals.

Hundreds (maybe even thousands?) of rounding and cross-selling plans are floating around out there. Many of them work. Unfortunately, many don't.

Traditionally, many agents ask their staff to offer additional policies at renewal and hope for the best. Some take a more proactive approach – compiling lists of clients with only one policy and directing staff to proactively reach out to clients and track the efforts' results.

While these "old-school" efforts can be effective, there are additional ways to increase your success and lower your operational costs this quarter. Here's a high-level outline to get your "Next-level" plan started:

Get Started on Your "Next-Level" Plan

STEP 1: Make selling everyone's job!

Start or continue building a sales culture where everyone is responsible for generating additional policies and up-selling current clients. Yes, you may encounter resistance, and some staff may be better suited at this than others.

Please make sure you set the expectation that everyone's focus, regardless of their role, is on helping the agency increase revenue and explain to them why it's important. Here are some tips:

-

Be sure the management team is onboard and can express how committed they are to their teams' efforts.

-

Show your teams how their efforts will contribute to the agency's health and growth and why it's vital to its future.

-

Give teams and individuals a monthly goal that aligns with the quarterly goals that you set during your planning.

-

Align rewards with these goals – they can be monetary, paid time off, or community-oriented.

-

Make everyone aware of how you will track performance and progress, so there are no surprises or pushbacks.

-

Provide your team with the tools, training, and support necessary to accomplish the goals you've set.

-

Leverage opportunities for carrier sales training and schedule group discussions to share strategies and discuss challenges.

STEP 2: Provide your team with the tools, training, and time necessary to accomplish the goals you've set.

Roll out a documented process, including an overview of the strategy that clearly explains who, what, where, when, why, and how this will work.

-

A good rule of thumb is to build three follow-ups into your process before marking the opportunity dead. That can be a combination of 2 calls and a personal email or two personal emails and a call. You can test it to see what works best.

-

Consider presetting the system's tasks so that the staff has a list to work from each day. This makes it more efficient for them and gives you the ability to track activities and progress to goal.

-

Build time into weekly meetings to discuss progress and refine any parts of the process that may not be working.

A few tips to consider:

-

Gain efficiencies and cut back on the staff workload by implementing an automated marketing program.

-

Use your agency management system or an outside customer relationship system (CRM) to automate some processes and warm-up clients before your staff reaches out to them personally.

-

Segment your book according to opportunities, Commercial Lines but no Personal, or BOP without commercial lines auto, for example – and set up an automated email campaign explaining coverages and benefits before the personal reach out.

-

-

Add systems into your process to increase your sales success odds to facilitate more employee engagement in sales. The more your staff experiences success, the more open they will be to selling.

-

Use client satisfaction data such as DONNA's SentiMeter®, Net promoter score, or other feedback to identify very satisfied clients who are likely to be open to conversations around increasing their coverages or purchasing additional products. After a positive claims experience is an excellent time to discuss additional coverages with a client!

-

Identify opportunities to review accounts for missing coverages or policies that your client may need and reach out proactively. Does your Commercial Lines client need the Hired and Non-owned Auto endorsement on their BOP? This is an excellent opportunity to reach out and discuss the coverage with your client proactively.

-

Leverage outside data on your clients to help you determine what additional products and coverages they may need from you. For example, if one of your clients registers a boat, a platform like Donna may be able to alert you to that and suggest proactively reaching out to the client.

-

STEP 3: Stay consistent

Consistency is critical to the success of any sales or marketing initiative. Many agents make the mistake of giving up on their process or losing focus when they don't see immediate results.

Be patient and continue to implement your process, manage your staff, and track results consistently. You may have a slow start, but with consistency, your efforts will compound.

Conclusion

Do more with the clients you already have by taking your account rounding and upselling efforts to the next level. Regardless of how focused your agency is on rounding out accounts currently, there is still an amazing amount of opportunities for additional policies sitting in your book right now.

Building a "Next-Level" Rounding and Up-selling Program consists of:

-

Expanding your view of "Rounded Accounts"

-

Knowing where you are and where you want to go

-

Fully Committing

-

Implementing a "Full Court Press"

Leveraging the data in your AMS, CRM, and marketing automation systems in your program will help you take your program to the next-level faster and efficiently.

Use client satisfaction data such as DONNA's SentiMeter®, Net promoter score, or other feedback to identify very satisfied clients who are likely to be open to conversations around increasing their coverages or purchasing additional products.

Focusing your revenue generation efforts on your existing clients offers significant benefits over new business production, including speed, ease, cost, and lifetime value.

Watch our Use Case video, "Easily Understand Agency Key Performance Metrics and Identify Opportunities" to learn more.