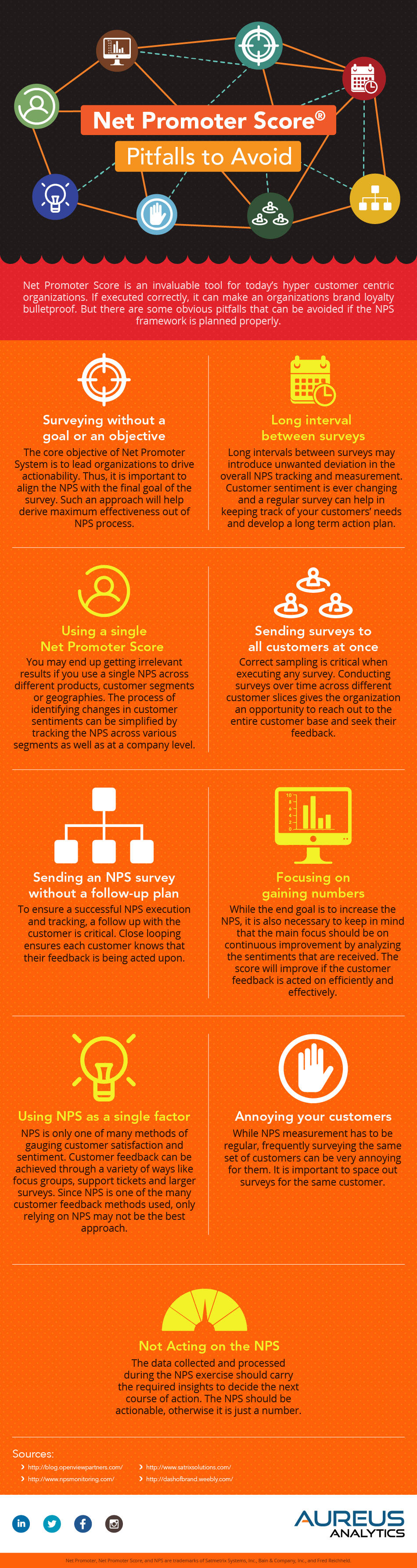

Net Promoter Score or NPS can be a tricky process to get right. There are many parameters that impact the execution and efficiency of the process. Even after the survey is concluded, it is paramount to close any loops with the customer. Below we highlight a few pitfalls that should be avoided while designing and executing the NPS.