This is Part 3 of our blog series, "Data Science Use Cases in Insurance."

The insurance industry isn’t the same as it was 20 years ago. It has become much more competitive as tech companies come into the picture with new and innovative ways to compete in order to gain a foothold in the insurance industry.

Consumers want to save money and will make their decisions based on the lowest price available. Some websites will help the consumer compare carriers’ prices and offerings to choose the best deal. Unfortunately, this is causing insurance companies to make price their priority over quality and customer satisfaction.

Our challenge is to get consumers to understand that there is more to an insurance policy than just the low price.

Consumers expect prospective insurance companies to provide the following:

- Personalization - they want to be more than just a policy number

- Unbundled pricing for each component – they want to pick and choose the level of coverage but at bundled prices

- Appreciation – They want to feel appreciated and understood. A little personalization goes a long way

Insurance companies are historically the last to join any bandwagon, especially if it has anything to do with new technology. In these times, they can’t afford to be tech-cautious. If they don’t get with the new technology, they’ll be left behind, which means losing market share.

Insurers need to strengthen their relationships with consumers by offering a wider range of personalized services. For example, life insurance companies can make the claim process go smoother by offering additional services to those dealing with the death of a loved one, such as:

- Registering a death

- Handling paperwork

- Contacting relevant authorities

- Offering financial guidance to the nominee

This type of personalized service is just the start. Insurers have so much information at their fingertips that can assist in providing well-personalized services to their customers. These days it’s all about customer experience – what can we do to make our customers happy and stay satisfied? Here are 3 different ways to target the right customer in the insurance industry.

#1 CUSTOMER SEGMENTATION

Customer segmentation is a way of separating and segmenting customers based upon certain characteristics. Once segmented, insurance companies can offer more personalized deals based upon the consumer’s likes and interests.

Historically, customer segmentation was done with typical demographic information such as age, gender, demographics, and behaviour. The problem with this approach is that it puts too many people in the same bucket and doesn’t allow us to take a deeper dive into their lifestyle preferences. As a result, it yields very little success. Many insurance companies are doing exactly this type of segmentation, and it’s not proving to be very successful. The result is a decrease in sales and falling behind their competition.

Insurers must take a new and different approach to customer segmentation to get ahead of the pack.

A Customer-centric Approach to Customer Segmentation

Customer centricity is all about understanding your customer’s needs and interests, leading to more personalized service offerings. Here is a shift in focus from age and gender to the customer’s lifestyle to create a holistic customer profile.

Some of the information which goes beyond the traditional socio-economic profile being used for customer profiling these days includes:

- Pre-purchase and post-purchase behavioral information along with demographics like:

- Timing of when the customer pays their premiums (by the due date, within the grace period, or randomly)

- Mode of payment

- Online savviness

- Use of Apps

- Presence on Social Media.

- Using external data such as credit history, credit score, shopping history, etc. as well can help us with customer segmentation

- Lifestyle details such as:

- Does the customer consume tobacco or alcohol?

- Hobbies like adventurous sports – are these sports hazardous or harmful?

- Are they employed in defense or fire-related services? If so, do they have any type of specialized training?

- Personal health details such as any pre-existing conditions or any severe or critical illnesses. This would involve a deep dive into the customer’s family history.

As you can see, there are so many ways to approach customer segmentation, yet insurers continue to classify consumers using the basic demographics. The simple descriptors such as age, gender, and employment status don’t shed light on career goals or personal passions.

Consumers want engaged insurers who cater to their specific needs. These are diverse groups of individuals, each on their own journey.

The Value of Customer Segmentation

Once customers are segmented using diverse profile attributes, marketing messages can be better tailored to their individual needs.

There are five important ways that customer segmentation helps insurance companies stay ahead of the competition.

- Optimizes marketing campaigns - With customer segmentation, marketing teams can focus on a specific group of customers which helps them in developing relevant and personalized offerings

- Identifies new opportunities - Customer segmentation of existing healthy customers can help in identifying new prospects with similar characteristics saving time, effort and extra money that goes into acquiring them

- Product innovation targeted towards niche segments - Segmentation can help insurers identify a buyer-focused market strategy that explains how and why their customers are different and caters to the unmet needs of their customers or specific group of customers

- Increases customer retention rates - The segmentation method makes it easier to group customers based on whether they are happy or unhappy, old, or new, and handle the customer’s needs in a smarter way.

- Offers personalized marketing communication - By segmenting their customers, insurers can better engage with them. Having a clear understanding of their needs, challenges, and pain points can help them develop suitable messages, customize targeting, and address specific customer requirements.

#2 CROSS-SELL AND PRODUCT RECOMMENDATION

Cross-Selling is a practice which not only exists in the insurance industry but other industries as well. It’s all about selling additional policies to existing customers. Cross-Selling to existing customers helps raise revenues while keeping acquisition costs low. A great advantage of this is that it improves brand loyalty.

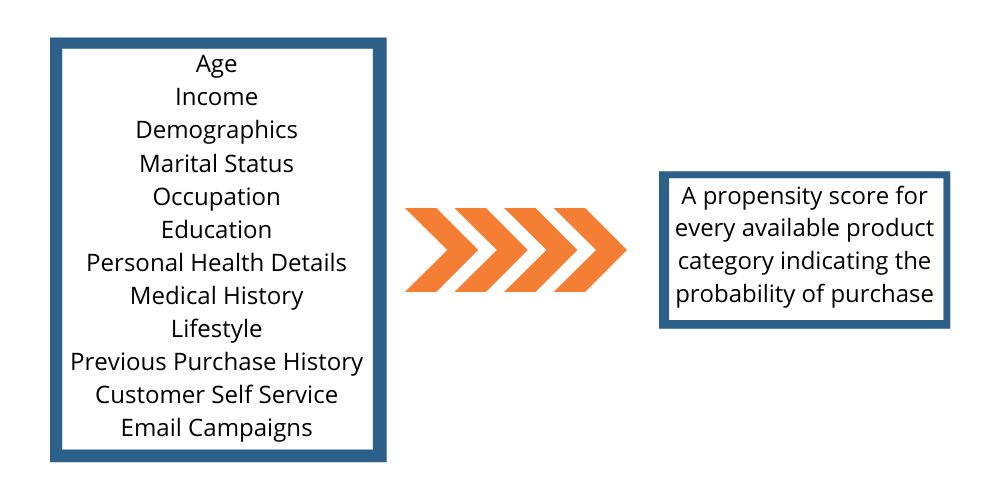

Insurance companies have a wide variety of products offering their key features and benefits. It becomes challenging for companies to recommend the right insurance product to the customers based on their preferences and financial needs. A machine learning-assisted Product Recommender will help solve this problem and target the right product to the right customers using different data points related to the customer. It will also help companies save a lot of time and effort by giving them what is necessary to the customer for the long term.

Key Considerations for Cross-Selling and Product Recommendation

1. What does the customer need?

E.g., Do they already have enough insurance cover? Are certain products likely to be beneficial to the customer?

- For each product category, establish whether the customer is likely to need the product

- This may be estimated based on

- Age

- Income

- Demographics

- Marital Status

- Occupation

- Education

- Personal Health Details /Medical History

- Lifestyle

- This can also include a check on whether someone else in the customer household has bought the same product recently

2. Does the customer profile match the available products?

Product suitability check: For each product category, establish whether the available product can be offered to the customer as per the expected target population for the product. E.g., If the target segment for ABCD insurance is customers between the age range of 30-45 years, this should not be offered to a customer aged 50 years.

3. Is this the right time to approach the customer?

- Do they have any pending complaints or grievances? If so, do not approach them for cross-sell until pending issues are resolved.

- Have they previously indicated that they do not want to get any additional offers? If so, remove them.

- Are they happy with the service?

- Were any offers made to them recently?

4. What does past experience tell us? Predictive modeling based on historical data takes into account:

- Customer demographics and life-stage

- Past behavior of the customer

- The behavior of similar customers in the past

Train a predictive model using supervised ML based on historical purchase behavior.

Cross-Sell, Upsell, and Product Recommendation is accomplished in insurance using Machine Learning techniques and algorithms such as Collaborative Filtering, Content-based Filtering, and Knowledge-based Recommender systems.

How Machine Learning Helps in Cross-Selling and Up-Selling for Insurance

Machine learning is key to personalized recommendations and improves cross-selling and up-selling opportunities. Segmentation is typically done using ML algorithms and helps us in personalization. As a result of these data-driven recommendations, customers will get the right offers at the right time and, therefore, will likely purchase more products.

Note: Hobbies and buying history data may not always be available to the insurer but may be obtained from external data sources in some cases.

Machine learning models for product recommendation are usually divided into two categories:

- Collaborative filtering

- Content-based filtering

These two approaches are often-times combined when building a recommender system.

#3 DON’T FORGET ABOUT CHURN ANALYSIS

Churn analysis is the process of evaluating your company’s loss ratio with the intent to reduce it. Less churn equals less customer loss, resulting in business stability. This can be a challenging task, though. Identifying your customer attrition rate helps to define the reasons for churn. Identifying the reason for churn is the first step in developing effective strategies to address it.

Using machine learning techniques to build churn models allows you to use many variables – far more than you would in a manual process. Since machine learning provides insights into your data, you will most likely see correlations and patterns that you would never identify on your own. Additionally, a machine learning approach will likely provide a much more accurate churn prediction.

Conclusion

Customer segmentation is key in targeting the right products for the right customer. Gone are the days when insurers would wait for the customer to come to them to purchase a policy. Insurers need to identify their target customer and provide smart offers that cater to their specific needs. Cross-selling could be an easy way to pick up business if insurers can identify any additional insurance needs a customer may have. Churn analysis is just as important as customer segmentation and cross-selling. An insurer must be willing to perform the necessary analysis to understand why a customer decides to bring their business elsewhere. Once you know the ‘why’ you can determine the ‘what’ – what you need to do to keep your customers from leaving.

In our upcoming blog, we will look into topics on Persistency, such as 13th Month Renewal, Non-13th Month Renewal, Lapse Revival Propensity Prediction, and Surrender Risk Prediction in the insurance industry.

Interested in learning more about understanding your customer's true sentiment? Click here to download our whitepaper, "Understanding SentiMeter®."